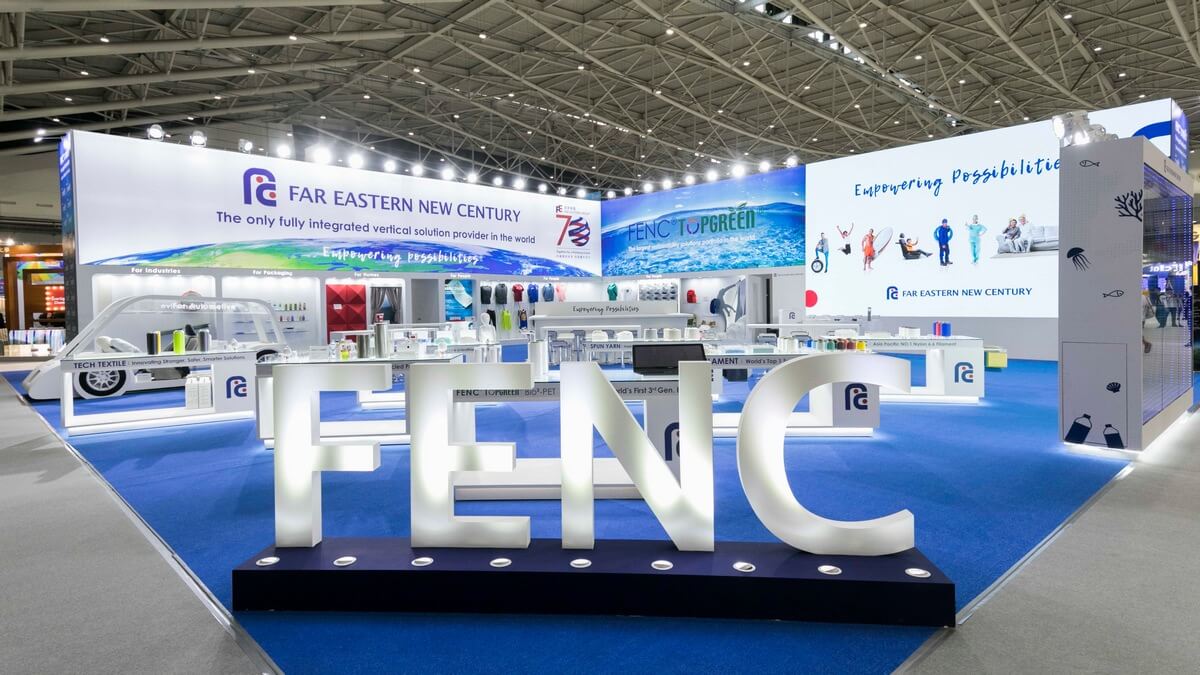

Innovative Competitive Edge, Leading the New Era

With 60 years of accumulated experience and growth, Far Eastern Textile has the competitive power to meet the challenges of the new era.

Far Eastern New Century Corporation’s Vice Chairman Johnny Shih is like a Far Eastern Group (FEG) encyclopedia where at any given time, he is able to tell an interesting FEG story, spread company spirit and communicate its vision.

Far Eastern New Century Corporation’s Vice Chairman Johnny Shih is like a Far Eastern Group (FEG) encyclopedia where at any given time, he is able to tell an interesting FEG story, spread company spirit and communicate its vision.

In 1967, Far Eastern Textile Ltd. (FETL) became a publicly-traded company. It was among the first 41 companies in Taiwan and the first textile company to go public. Of these 41 companies, 19 are no longer in business. Mr. Shih says, “Walking down this path, many companies have closed shop. We seem to be one of the few that’s still growing, and this truly sets us apart from our competitors.”

Critical Decision

In 1967, the American company Monsanto ceased supplying raw materials to FETL. As a result, Far Eastern Group founder, Mr. Yu-Ziang Hsu, shifted FETL’s focus towards the upstream supply chain to streamline the business. In 1969, Mr. Hsu established Oriental Chemical Fiber Corporation (OCFC) to supply FETL upstream materials. Johnny Shih believes that founder Yu-Ziang Hsu’s vision and foresight put FETL on the steady footing that led to its strong leadership in the Taiwan textile industry.

At that time, there were two fiber-producing processes, which used the raw materials Purified terephthalic acid (PTA) and Dimethyl terephthalate (DMT) respectively. DMT was the mainstream material in the market while PTA due to technological limitations was more difficult to produce with only three companies worldwide with the ability to produce it. Mr. Yu-Ziang Hsu, believed FETL should possess “the best technology, state-of-the-art equipment, and the lowest plant production cost” in the business. Despite a 7% higher cost to adopt the PTA process, raw material costs at the time of production were reduced by 15%. After evaluating the risk and potential of the new technology, Mr. Hsu decided to collaborate with the Swiss company Inventa to set up the chemical fiber production process utilizing the PTA material sold by American company AMOCO. OCFC became the first company in Asia to produce chemical fiber using PTA as the main raw material. After forty years, Mr. Yu-Ziang Hsu’s decision was a wise one with PTA currently the mainstream technology having completely replaced the need for DMT.

Despite high plant construction costs, OCFC posted profits early in its operations and in 1972, after its third year of operation, posted an NT$1 billion profit. At that time, Mr. Yu-Ziang Hsu embarked on another venture to introduce the newest technology partially-oriented yarn (POY). The production process was shortened by one step to reduce costs and increase efficiency beginning what was a major breakthrough in the textile industry at the time.

When the first global energy crisis occurred in 1973, the number of downstream textile businesses in Taiwan dropped to 30 from over 120. Johnny Shih recalls that due to a greater number of delinquent accounts and a lack of fair trade laws, FETL decided to revise its customer payment method from 90 days credit to a mandatory down payment, in cash. Since then FETL has strengthened its corporate governance through its vigilant payment terms management.

International Collaboration

In 1987, FETL collaborated with the West German company Freudenberg and Japanese company Vilene. The three firms invested NT$1 billion to establish Freudenberg Far Eastern Spunweb Co. Ltd. to produce non-woven industrial fabrics and related high-tech polyester fiber products. This was Freudenberg’s only manufacturing venture in Asia involved with non-woven polyester fiber products. In the same year, FETL also introduced Air Liquide’s production technology to establish Air Liquide Far Eastern Co. Ltd., investing NT$230 million to produce industrial gases. FETL then collaborated with American company DuPont in 1995 to establish Far Eastern DuPont Co. Ltd. Guanyin Plant to produce high-tech nylon 66. FETL also set up ICI Far Eastern Ltd. with British company ICI to establish a PTA Plant in Taoyuan County, northern Taiwan. (ICI transferred equity to DuPont in 1997, and was renamed DuPont Far Eastern Petrochemicals Co. Ltd.; DuPont sold its textile department to Koch Industries in 2004, and the company renamed again as Invista Far Eastern Petrochemicals Co. Ltd.)

These international companies when entering the Asian market chose FETL as their preferred partner for good reason. FETL has good communication with foreign firms and their staff thanks to a long history of overseas trading characterized by financial transparency and an innovative spirit. Over the past 20 years, FETL has established partnerships with many international companies, set higher goals, and focused on improving the value added services and contributions it brings to the marketplace and its community. For instance, FETL has transformed itself from a traditional cost center to a profit center. Every department and factory has its own financial reports, including income statements and balance sheets. “These types of experiences raised our teams’ standards to the international level,” Johnny Shih pointed out. While forming strategic alliances, thorough analysis, feasibility studies and due diligence needed to be carried out, discussed and debated. Even political situations, business operations, and technological uncertainties have had to be evaluated in order to create a better, more resilient business management model. International collaboration has had a profound impact on FETL’s management style.

By engaging with international corporations, Johnny Shih realized the importance of streamlining operations vertically to provide more complete information and reduce risk. “This is the key point for business model reform,” he says. In 2008, Invista disinvested and FETL took over the entire operation renaming the PTA factory Oriental Petrochemical (Taiwan) Corporation. In 2009, Oriental Petrochemical turned the corner from financial loss to profit showing FETL’s management team is proving its worth.

Leader in Industry, Brand, and Innovation

“Far Eastern Textile transformed from apparel to non-apparel; from textile to non-textile products,” Johnny Shih says: “These decisions were a turning point for our operations.” Outlining the future strategy, Johnny Shih emphasizes that there are three major directional focuses: leadership in industry, brand and innovation. We think the three critical factors to our achieving these goals are our strategic layout in China, vertical integration and continuous innovation. Of these three, innovation is the most important.

In order to reinvent ourselves in the non-textile area, FETL has had to keep abreast of the latest advances from abroad to introduce state-of-the-art technology and work closely with our research and development team. At the end of 2002, our textile sub-group reorganized its forces and established Far Eastern Group R&D Center. R&D’s core focus is to expand the group’s non-textile applications. Our fiber and polymer divisions focus on the development of FETL’s core businesses and added-value materials. With Taiwan’s photoelectric and biochemical technology industries on the rise, the R&D center also established the optoelectric and biotech divisions in order to meet the demand for optical thin film and medical materials.

Johnny Shih believes that FETL must break out of the traditional polyester and textile model and create its own brand value. “In our customers’ eyes, we are also a brand. Currently, we estimate 70% of our customer-partners are here because of the ‘Far Eastern’ brand.” He emphasizes that the only way to keep customers is to enhance our products’ quality and value, and speed up R&D. By doing so, customers see us as reliable and with planning capabilities creating peace of mind. Amid the global financial crisis in 2008 and during the period of the U.S. economic recession (from December 2007 through July 2009), FETL’s polyester and textile business despite the odds stacked against it grew 8% that year.

FETL entered the Chinese market in 1988 after seven years of market research and regulatory approval. In 1995, having finally being able to invest in a Shanghai plant, FETL became one of the first Taiwanese companies to have sole proprietorship over its investment in China.

In China, FETL introduced an integrated operating model to control quality, lower costs and increase efficiency in production lines. With upstream headquarters in Shanghai the midstream/downstream headquarters in Suzhou one can see product lines of staple fibers, filaments, and Polyethylene Terephthalate (PET). Staple fibers line includes spinning, weaving, dyeing and apparel. Filament line includes false-twist and industrial yarn. As for PET, the main products are PET chips for drinking bottles, perform, and APET film.

Create Brand Power

The operating environment in China never ceases to be challenging. In 2008, amid the global economic recession, PTA plants and spinning factories in China across the board slashed production and in some cases faced bankruptcy. The changes taking place, however, opened new windows of opportunity in industrial tire cord, electronic packaging materials, and PET bottles, etc. Non-textile product now accounts 76% of FETL revenue. The product applications cover electronics, food, automobiles, construction, medical use, sanitary materials, and more, making high-tech innovation applied to textile products a focus of the future. At the 2006 FIFA World Cup, seven out of the final 16 teams wore Nike 3D jerseys. Products of FETL’s innovation these colorful jerseys were: UV resistant, highly elastic, and sweat- and dirt-repellent.

“After the economic crisis hit, we cut all costs except R&D, which was necessary for growth. When collaborating with name brands, the need to reinvent, research, and innovate, continue to maintain momentum. To stop your business from growing; you face market elimination or elimination by your customers,” Johnny Shih points out.

Approximately 70% of FETL’s customers are major key name-brand customers. Working with these customers long-term, the FETL brand must be trustworthy and reliable with a strategy, which includes staying in the top three at every level of the industry. Through our own branding and integration with customer brands, the company is able to form strong strategic alliances. Competitors are unable to replicate the close relationships we maintain with our customers – especially when it comes to cost control.

In 2008, there was a greater need to tackle cost issues along with the carbon footprint reduction mandate. FETL embraced action plans on many fronts to simultaneously deal with these issues. FETL was able to trim NT$52 million in costs from management, equipment outlays, product structure, and production process, while at the same time effectively reaching the goals of environmental protection, social responsibility, and operational efficiency. Amazingly, these reductions took place in a single month.

Far Eastern Textile renamed Far Eastern New Century on the 60th anniversary acts as the parent company in the Far Eastern Group. Of the eight public listed companies owned by Far Eastern Group in Taiwan, FETL is a significant shareholder in seven of them. In addition, FETL counts an abundance of land among its assets. This brings flexibility to its business operations and shows promise for the company’s future. “Many foreign and Chinese investors want to invest in FENC. They see the potential of our structure and value,” Johnny Shih says. The future development of Far Eastern Group depends on Far Eastern New Century’s strategic plan.

Business and Company

News Type

UN SDG

Share

Source

60th Anniversary Book - Mission of Business Future