Loading

Loading

The Far Eastern Group through corporate innovation, globalization, and social responsibility continues to remain engaged and creative in the face of the unexpected changes the future holds, with a vision towards a new horizon.

In 2023, the retail industry gradually emerged from the haze of the pandemic. Not only did e-commerce grow explosively during the epidemic, but after the pandemic was lifted, physical retail stores ushered in unprecedented prosperity. But how long will this good situation last? How should we respond to the many uncertain factors in the business environment?

Read More

Marching into the new year, FEG has posed a fresh start, including new leaders of Shangri-La’s Far Eastern Plaza Hotel, Taipei, Yuan Ze University, and Far Eastern Memorial Hospital, hopefully with our joint efforts, we will expand new horizons for FEG in the future.

Read More

Volatile pandemic situation has clouded the world economies, posing uncertainties for enterprises about the future in forecasting basic data such as fuel and utility prices. Only being able to quickly respond to the changes were we able to succeed in shaping the new models.

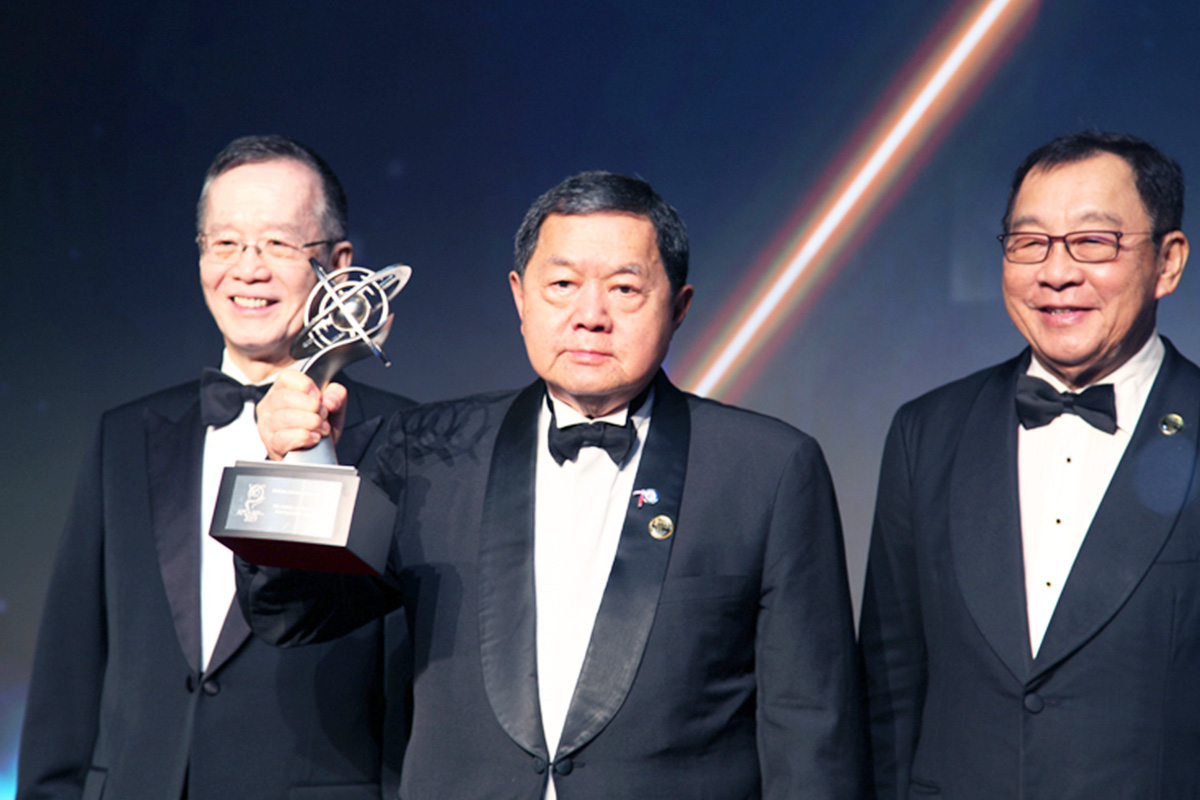

Read MoreDouglas Tong Hsu was awarded the "Honorary Award" for his lifetime achievements presented by former President Ma, Ying Jeou at Global Views Leaders' Forum

Read More

In recognition of outstanding entrepreneurs, the Asia Pacific Entrepreneurship (APEA) established by Enterprise Asia marked its 13th year this year. Chairman Douglas Tong Hsu was awarded the highest honor "Special Achievement Award" for breaking through restrictions and keeping setting up new standards and models.

Read More

FEG for the first time sponsored Fuerza Bruta Wayra, a digital literary creator from Argentina. It combines dance, physical fitness, drama and stage technology to break the existing stage framework and experience immersion theater in 360 degrees and 4D space.

Read More